Watching reels that say “Buy from IndiaMART for ₹150 and sell on Amazon for ₹350 to make lakhs per month?”

🚨 WAIT! Don’t start selling yet. You might end up in loss instead of profit.

Let’s break this down with a real-life example and reveal the hidden costs most new sellers don’t consider.

Table of Contents

The Misleading Promise

Case Study: ₹150 Product Sold for ₹350

Amazon Fee Breakdown

GST Calculation and ITC

Hidden Costs (Ads, Packaging, Returns)

Final Profit Calculation Formula

Conclusion: What You Must Learn

The Misleading Promise

Buy a product for ₹150 → Sell for ₹350 → Earn lakhs every month.

Sounds easy, right? But let’s look beyond the surface and calculate the actual profit.

Case Study: ₹150 Product Sold for ₹350

Let’s say you buy a bottle for ₹150 from IndiaMART and list it on Amazon for ₹350. Here’s how the math works out.

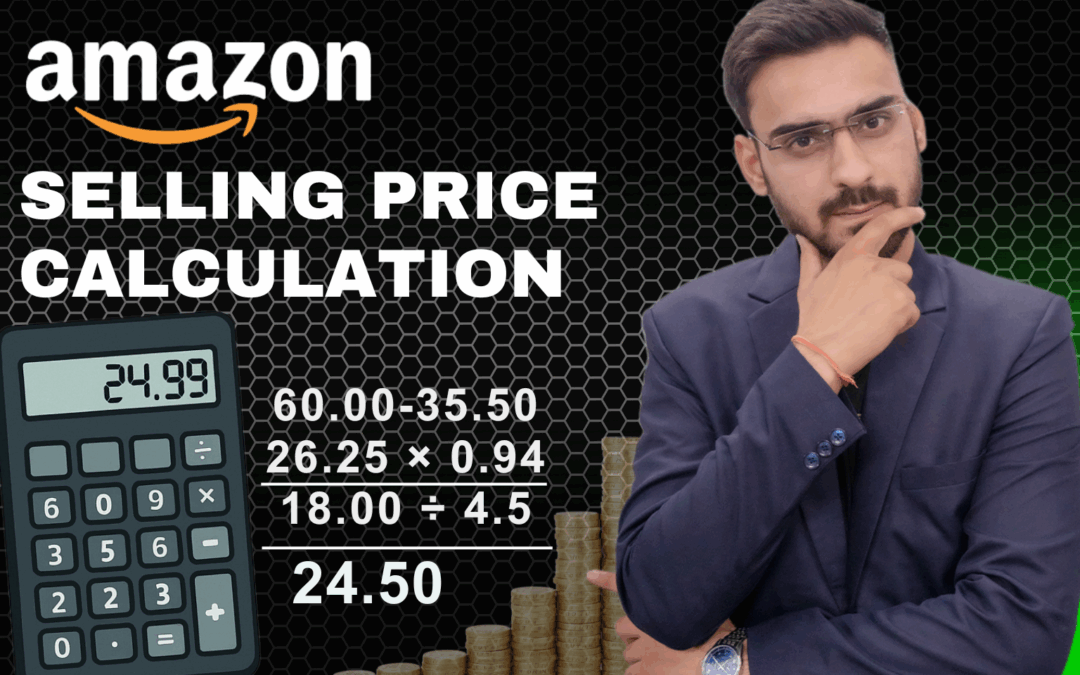

Amazon Fee Breakdown

Fee Type Amount

Selling Price ₹350.00

Referral Fee (5%) + ₹17.50

Fixed Fee + ₹10.00

Shipping Fee (below 500g) + ₹65.00

gggggggggggggg ____________

ggggggggg ₹92.5

Amazon GST on fees (18%) + ₹16.65

gggggggggggg ____________

Total Amazon Charges ₹109.15

Bank Settlement (Payout) ₹350 – ₹109.15

gggggggggggggggggg ₹240.85

GST Calculation and ITC

Bank Settlement ₹240.85

Product Cost – ₹150

Product GST (12% of ₹350) – ₹42

ITC + ₹16.65

ggggggggggggggggg ____________

Profit ₹65.5

Hidden Costs (Ads, Packaging, Returns)

Most beginners forget about real-world operating costs like:

Profit ₹65.5

Advertisement Cost – ₹20

Packaging Cost – ₹10

Return Cost – ₹30

gggggggggggg ____________

Actual Profit = ₹5.5

But after all actual expenses, your true profit is only ~ ₹5.5 per unit.

Conclusion: What You Must Learn

📌 Don’t trust clickbait videos blindly.

📌 Always calculate your real profit before listing.

📌 Use Amazon’s Fee Calculator and include: GST, Ads, Packaging , Return rates 📌 Start slow, test, then scale.

Need Help Calculating Your Product Price or Profit?

Drop us a message.

We’ll help you launch and scale profitably in 2025 — without burning money.

Nice